What We Do

The Meridian Effect

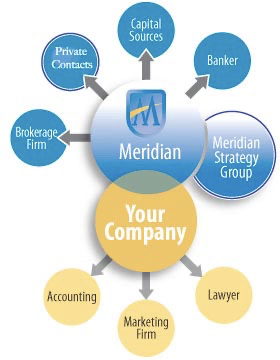

We believe that advisory services should be more than finding and arranging capital. Our emphasis is on the full spectrum of ongoing business relationships that define an organization, rather than a particular set of financial transactions.

It’s a sad fact that generally bankers don’t understand entrepreneurs and entrepreneurs don’t understand bankers. We bridge that gap of understanding because our people have experience on both sides of the equation. We’re proudly re-inventing the relationship between entrepreneurs and capital sources because we understand the disconnect and in most cases, know how to fix it.

Often, banks are not in a position to fully support the financing needs of growing, successful companies. Early stage, especially pre-revenue companies are generally too high risk for bank financing. That’s where our network of over 500 private capital sources and our experience in the Angel Investing world come into play.

Our approach to advisory services is to fully support our clients by providing comprehensive strategic planning and high level advice backed by years of experience as bankers AND entrepreneurs. We build a team within the organization that can provide the knowledge and leadership to implement the vision of the company and its owners — and of course advise and assist in finding the capital necessary to make it all happen.

When necessary we will place our own people, who bring with them decades of entrepreneurial and financial management experience, right into the organization. Our broadly experienced team of high caliber advisor strategists can provide the means to execute not just give advice to our clients. Then as the company grows and its needs change, our services will change to reflect that growth – always providing the right support and resources at the right time

“When we put the right skills and people in place, it is a given that the money will be there – the right people, the right capital, at the right time, that is “the Meridian Effect.”

— Randy Lennon, Co-Founder.